By Olawale Fatunwase

In my precious article, I introduced you to real estate investing and listed the economic and demographical factors that currently make investing into the Nigerian real estate market a lucrative business. In my article today, I discussed why, if you must play safe and smart in the industry, you need to understand the market, differences in regional developments within the country, and current and future trends to pay close attention to in real estate peactice.

To succeed in real estate investing in Nigeria, it’s crucial to understand the dynamics of the market. The Nigerian real estate market is influenced by a variety of factors, including population growth, urbanization, economic trends, and government policies. This section will explore these factors, highlight regional differences, and discuss current trends and future projections to help you make informed investment decisions.

Key Factors Driving the Nigerian Real Estate Market

Population Growth and Urbanization

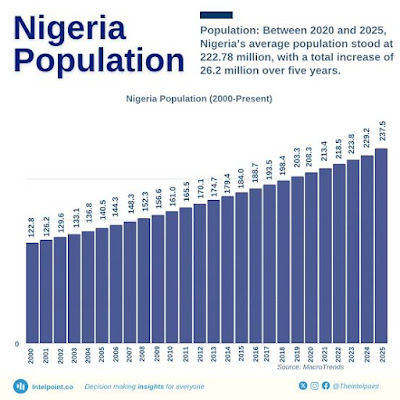

Nigeria’s population is growing at an annual rate of about 2.6%, making it one of the fastest-growing populations in the world. This growth is concentrated in urban areas, leading to increased demand for housing and commercial spaces.

Cities like Lagos, Abuja, and Port Harcourt are experiencing rapid urbanization, with people migrating from rural areas in search of better opportunities. This migration fuels the need for residential, commercial, and industrial properties.

Example: Lagos, with a population of over 20 million, has a housing deficit of over 7 million units. This deficit presents a significant opportunity for real estate investors to develop affordable housing solutions.

Economic Trends

Nigeria’s economy, though faced with challenges like inflation and currency fluctuations, remains one of the largest in Africa. The real estate sector contributes about 5-6% to the country’s GDP.

The rise of the middle class and increasing disposable incomes have led to higher demand for quality housing and modern commercial spaces.

Example: The growth of tech hubs and coworking spaces in Lagos and Abuja reflects the increasing demand for flexible office spaces driven by the startup ecosystem.

Infrastructure Development

Government and private sector investments in infrastructure are opening up new areas for real estate development. Projects like the Lagos-Ibadan Expressway, Abuja-Kaduna Railway, and Eko Atlantic City are transforming the landscape and increasing property values in surrounding areas. Improved infrastructure reduces the cost of construction and makes previously inaccessible areas attractive for development.

Example: The construction of the Lekki Deep Sea Port and the Dangote Refinery in the Lekki Free Trade Zone has significantly boosted property values in the Lekki-Epe corridor.

Government Policies and Incentives

The Nigerian government has introduced various policies and incentives to encourage real estate development, such as the National Housing Fund (NHF) and the Federal Mortgage Bank of Nigeria (FMBN). Tax incentives and public-private partnerships (PPPs) are also being used to attract investors to the sector.

Example: The Family Homes Funds initiative aims to provide affordable housing for low-income earners, creating opportunities for developers and investors.

Regional Differences in the Nigerian Real Estate Market

Lagos

Lagos is Nigeria’s commercial capital and the most active real estate market. Areas like Ikoyi, Victoria Island, and Lekki are known for high-end residential and commercial properties. Emerging areas like Epe, Ibeju-Lekki, and Ajah are becoming popular due to infrastructure developments and relatively lower property prices.

Example: A 3-bedroom apartment in Ikoyi can cost upwards of ₦150 million, while a similar property in Epe might cost around ₦30 million, offering significant potential for appreciation.

Abuja

As the administrative capital, Abuja is known for its planned layout and high demand for both residential and commercial properties. Areas like Maitama, Asokoro, and Wuse are prime locations. The development of the Abuja Airport and the Abuja-Kaduna Railway has boosted property values in surrounding areas.

Example: A plot of land in Maitama can cost over ₦500 million, while areas like Kubwa and Gwarimpa offer more affordable options with good potential for growth.

Port Harcourt

Port Harcourt, the hub of Nigeria’s oil and gas industry, has a strong demand for residential and commercial properties. Areas like GRA Phase 1 and 2 are prime locations. The city’s real estate market is influenced by the activities of multinational oil companies and their expatriate staff.

Example: A 4-bedroom duplex in GRA Phase 1 can cost between ₦180 million to ₦300 million, depending on the level of finishing and amenities.

Other Cities

Cities like Ibadan, Kano, and Enugu are also experiencing growth in their real estate markets, driven by urbanization and economic activities. These cities offer more affordable investment opportunities compared to Lagos and Abuja, with potential for significant returns as they develop.

Example: A plot of land in Moniya, Olorunda-Akobo or Egbeda in Ibadan might cost around ₦5 million, offering a more accessible entry point for beginners.

Current Trends and Future Projections

Affordable Housing

There is a growing focus on affordable housing to address the country’s housing deficit. Developers and investors are exploring innovative solutions like modular housing and public-private partnerships.

Technology and Proptech

The adoption of technology in real estate (proptech) is transforming the sector. Online platforms like PropertyPro, NigeriaPropertyCentre,

Jiji.ng are making it easier to buy, sell, and rent properties. Virtual tours, online payments, and digital marketing are becoming standard practices.

Sustainable Development

There is increasing awareness of the need for sustainable and eco-friendly buildings. Green building practices and energy-efficient designs are gaining traction.

Co-living and Co-working Spaces

The rise of the gig economy and remote work is driving demand for co-living and co-working spaces, especially in urban areas.

Future Projections

The Nigerian real estate market is expected to continue growing, driven by population growth, urbanization, and infrastructure development. Emerging areas along new transport corridors and industrial hubs are likely to see significant appreciation in property values.

Conclusion

Understanding the Nigerian real estate market is the foundation of successful investing. By recognizing the key drivers, regional differences, and current trends, you can identify lucrative opportunities and make informed decisions. In the next section, we’ll explore the various types of real estate investments available in Nigeria and how to choose the right one for your goals.

Until then, stay sharp and active.

Comments